Metals pull back as dollar squeeze continues

* Yen weakest since mid-February, euro drops as USD hits 9-week highs

* Gold slides below $4,000, Silver races to $50 and retraces

* Wall Street rally pauses record-breaking rally as earnings approach

* US shutdown drags on with Republicans and Democrats trading blame

FX: USD rose for a fourth straight day which hasn’t been seen since the end of July, as the squeeze in dollar shorts continued. Prices have hit a zone which includes the swing low from July 2023 at 99.57 and a minor Fib level of this year’s drop at 99.51. The start of August top sits at 100.25. The US government shutdown continued to limit the release of key economic data, including weekly initial jobless claims, and progress towards a deal remains limited. Thursday’s Fedspeak included welcoming remarks from Fed Chair Powell but nothing on Fed policy.

EUR broke down further and through the 100-day SMA at 1.1631 and a major Fib level of the August to September move at 1.1592. The minor retracement level of the august to September move sits at 1.1504. We had said previously, if the 1.1655 area breaks, then we could see more downside fairly quickly. French politics remain uncertain but slightly brighter as a new PM looks to be named on Friday evening. That has seen France-Germany yields spreads narrow which typically would help the euro. The chances of a French election by the end of the month were halved to around 34%.

GBP underperformed with cable falling below early and late September lows around 1.3330. Hawkish talk from BoE official Mann didn’t help, who said policy needed to remain restrictive for longer to squeeze out inflation persistence.

JPY actually outperformed its major peers but still settled lower versus the greenback. Prices remain above the major Fib level (61.8%) of the January to May drop at 151.67. The next Fib level sits at 154.81. The ‘Takaichi trade’ – lower yen, higher stocks, steeper yield curve – has inevitably slowed with her economic measures and PM nomination said to be likely delayed.

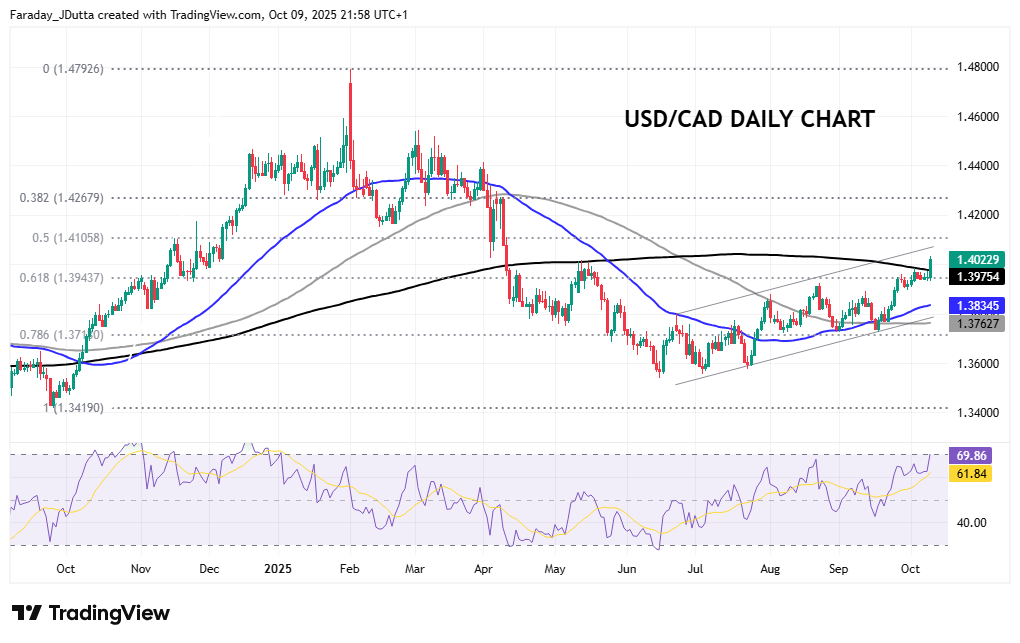

AUD fell to the 50-day SMA at 0.6550. NZD continued to underperform as it still felt the effects of the dovish RBNZ bumper rate cut and guidance. A major Fib level (61.8%) of the year-to-date April low to June high sits at 0.5727. CAD broke to the upside above the 200-day SMA at 1.3975. The loonie outperformed its peers apart from the yen, with hopes of a US-Canada trade agreement incoming.

US stocks: The S&P 500 lost 0.28% to close at 6,735. The Nasdaq moved lower by 0.15% to settle at 25,098. The Dow Jones finished at 46,358, down 0.52%. Materials, Industrials and Energy suffered the biggest declines losing over 1.3%, while Consumer Staples was the only sector in the green (+0.61%). The publication of Q3 earnings are nearly upon us with analysts forecasting earnings growth for S&P 500 y/y results of 8.8%, weaker than the 13.8% seen in Q2 and 9.1% a year ago. Tech is once again expected to lead (22.2%) with Energy down (-5.1%). Delta Airlines jumped over 4% with an upbeat forecast after stronger than expected Q3 earnings.

Asian stocks: Futures are mixed. Stocks traded mainly higher on the tech led rebound Stateside and the Gaza ceasefire deal. The ASX 200 edged higher on mining and materials strength. The Nikkei 225 hit fresh highs on tech and AI gains with Softbank soaring as investors bought into its AI robot vision. The Hang Seng and Shanghai Comp rose to multi-year highs as the latter reopened after Golden Week. The decision to take Hang Seng bank private by HSBC saw the former soar.

Gold fell over 1.6% after not quite making fresh record highs. Profit taking seems in order after 50%+ gains this year. Silver also sold off after fresh highs.

Day Ahead – Canada Jobs

The BoC noted a softer labour market at its recent meeting, with markets pricing in around a 60% chance of another 25bps rate cut at its meeting in late October. The August unemployment rate hit a nine-year peak, barring the pandemic years, while the economy shed 65,500 jobs largely in part-time work. September data is expected to see a small positive headline print which would be a relatively muted rebound after tow months of heavy layoffs. The jobless rate could pick up one-tenth to 7.2% with wages holding steady.

Chart of the Day – USD/CAD breaks to the upside

USD/CAD has been in a mild upward channel since the June low belwo 1.36. The recent consolidation was notable, with congestion centered around the 61.8% retracement level of the September 2024/February 2025 rally at 1.3943. The 200-day SMA at 1.3975, just below the psychologically important 1.40 level made this a resistance zone. A stronger than expected employment report could see weakness below 1.3900 that would likely target the 50-day SMA at 1.3834. The midpoint of the rally sits at 1.4105 and will be a target for loonie bears if the jobs data is weak and sees more BoC rate cuts priced in.