Huge stock turnaround as NVDA post-earnings gains faded

* Wall Street indexes end lower after sharp reversal, tech leads drop

* Nvidia closed lower after strong results, Walmart holds higher

* Bitcoin slides below $87,000, down 30% from all-time high

* Fed officials showing caution, even as some call for December rate cut

FX: USD printed a doji candle denoting some indecision after it pierced the 200-day SMA at 99.91. This had capped the upside earlier in the month at 100.36. We got a mixed September NFP report with a big beat on the headline but 33k of downward revisions over the previous two months. The unemployment rate also ticked higher than expected at 4.4% while wage growth came in one-tenth below estimates at 0.2%. All in all, a mixed data set amid much uncertainty about the economy amid the shutdown and reopening. Key now is the fact we don’t get any more major labour market figures until after the December FOMC meeting. The odds of a 25bps rate cut sit at 40% now, up from 30% before the NFP release.

EUR turned lower for a fifth day in a row and touched a minor Fib level (23.6%) of this year’s rally at 1.1507. Focus is on today’s PMIs with little other major data being seen recently. The ECB is neutral in its outlook, which has been clearly communicated.

GBP was the leading major as it gained versus the dollar and traded around the 50-week SMA at 1.3124. Budget speculation continues as the 10-year Gilt yield stabilised around 4.6% after its sharp move higher on Wednesday up to the 200-day SMA.

JPY weakened again as the major hit fresh multi-month highs above 157.50. The year-to-date January top is at 158.87. PM Takaichi’s fiscal plans are seeing BoJ near-term rate hike bets pared, while expectations of tightening in the new year pick up. The yen reclaimed some losses as risk sentiment turned red. There was more verbal intervention overnight but it had little impact.

US stocks: The S&P 500 lost 1.56%, closing at 6,539. The Nasdaq moved lower by 2.38% to finish at 24,045. The Dow settled down 0.84% at 45,752. Tech and Consumer Discretionary led the losers, down 2.66% and 1.73% respectively with Consumer Staples the only sector in the green, up 1.11%. Walmart jumped 6.5% on the day after it saw EPS, revenue and comparable sales all beat, while it bumped up its outlook ahead of the holiday season. It also said it was moving its listing to the Nasdaq, after 55 years on the NYSE. Of course, Nvidia was the major story initially up 6%, before the turnaround after the open and closing 3.2% lower. It beat and raised guidance with demand and supply stellar, but the risk-off mood hit tech hard with no fresh driver. There had been commentary in yesterday’s FOMC minutes about risks of equity downside and AI valuations are a concern still, while NVDA client concentration risk remains high.

Asian stocks: Futures are mixed. Stocks jumped helped by NVDA’s perceived solid earnings and guidance which buoyed tech stocks. The ASX 200 was supported by tech and gold. The Nikkei 225 surged above 50k but gave back gains amid ongoing Japan-China tensions and as Japanese government bond yields continued to move north. The Hang Seng and Shanghai Composite were bid though the mainland lagged its peers amid the US-China AI race.

Gold traded around the major Fib retracement level (38.2%) of the early September break to the record high in November at $4,044. The precious metal was relatively quiet, printing a doji candle and not picking up any safe haven bids as the risk rally turned lower.

Day Ahead – PMIs

This data typically serves as a leading indicator with survey figures preceding hard data. That said, the soft surveys in recent months haven’t always been seen in activity data releases. Eurozone services PMI should likely bolster the composite print in region, with manufacturing expected to stabilise around the neutral 50 mark. But there’s recently been a series of disappointing hard data with weak industrial production and retail sales signalling an ongoing soft backdrop. It seems that global headwinds still linger over Germany in the form of China’s muted growth and US tariffs. Country wise, France lags, Italy and Germany are soft while Spain is the standout performer.

UK PMIs may be clouded by budget uncertainty again, after worse than expected metrics in September. Consensus expects lower figures with Services and the Composite printing in the high 51s and manufacturing still in contraction at 49.1. With so much focus on next week’s Budget, the figures could add to the downbeat mood in the UK or be looked through as markets await that major risk event.

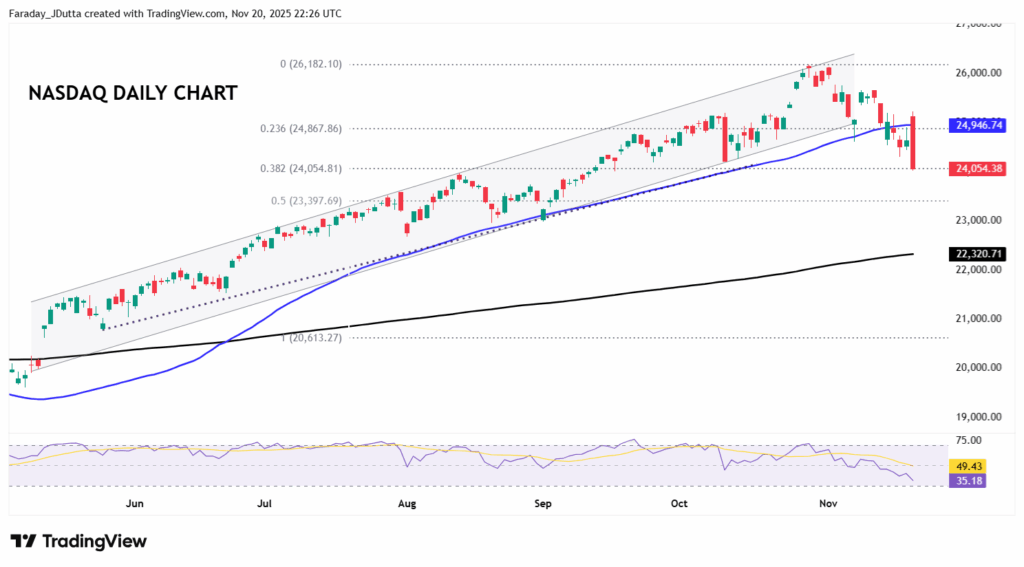

Chart of the Day – Nasdaq prints huge bearish engulfing candle

With Nvidia’s weighting around 10% in the tech-heavy Nasdaq, it’s no surprise that its earnings would have a huge influence on where the index goes, as we have stated previously. Prices have fallen close to 8% from the record high print at 28,182 from late October, and out of the bull channel seen since mid-May. This series of higher highs and higher lows was also supported by the 50-day SMA which has been broken recently. That currently sits at 24,946. Yesterday’s intraday price action looks bearish with the gap higher on the open quickly being filled and the index falling sharply. That has seen a big bearish engulfing candle print, with a major Fib retracement level (38.2%) of the May to October rally at 24,054. The midpoint of that move sits at 23,397.