Mixed stocks kick off December, USD edges lower

* Stocks fall, yields rise as investors take a breather to assess Fed moves

* Dollar eases versus yen as BoJ’s Ueda hints at rate hike

* Gold hits 6-week high, Silver posts new record high as momentum continues

* Bitcoin prices fall below $84,000 in sharpest decline since March

FX: USD was lower again for a seventh straight day, which has not been seen since the end of June. The Dollar Index moved away from its 200-day SMA at 99.67 and touched the 50-day SMA at 99.05 before finding some buyers. Prices haven’t closed below that indicator since the start of October. Yen strength is working against the dollar in the Index. US ISM Manufacturing printed weaker than expected at 48.2 vs 49.0. December rate cuts odds are now above 90%, so nailed on. Kevin Hassett, the rumoured front-runner for the Fed’s leadership who is a policy dove could be confirmed this week. It seems like strong hawkish signals are needed to lift the dollar and short-term rates.

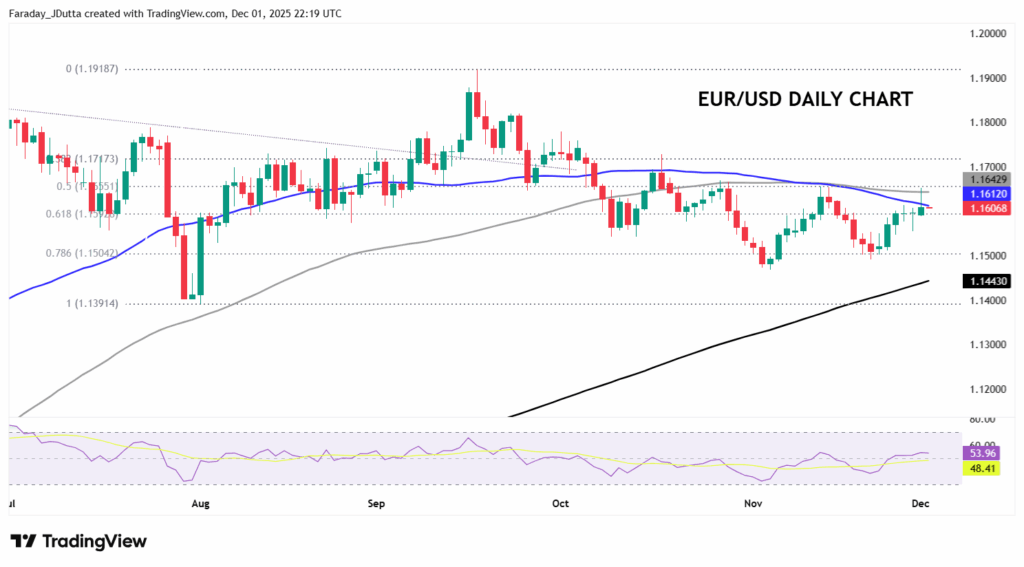

EUR pulled back after touching the 100-day SMA at 1.1643. But the euro was the second best performer on the day after the yen. The two-year German-US yield spread is sitting just below its recent 14-month peak. See below more on today’s inflation data and the technicals on the major chart.

GBP was mid-pack among its peers after cable touched the 50-day SMA at 1.3274 before settling close to 1.32. It hasn’t closed above that indicator since early October. There are a few BoE speeches this week from various doves and hawks this week. But it’s a very high bar to change the bets on a 25bps rate cut later this month, with around 53bps of easing predicted by June.

JPY was the big outperformer after hawkish comments from BoJ Governor Ueda saw the major drop to a low at 154.66 before paring losses. He stated that the BoJ would ‘consider the pros and cons of raising the policy rate’. But he also hinted that there is no clear opposition by new PM Sanae Takaichi to raising rates. This second factor had been crucial for markets, whose basic understanding was that Takaichi was a dovish-leaning influence. This year’s low to high move has a minor Fib level (78.6%) at 154.84. Rates have now priced in around 20bps of a rate hike at its meeting this month on December 19, up from 14bps.

US stocks: The S&P 500 lost 0.53%, closing at 6,813. That halted a 5-day win streak. The Nasdaq moved lower by 0.36% to finish at 25,343. The Dow settled lower by 0.89% at 47,289. Energy led the only two sectors in the green after OPEC+ confirmed plans to pause output hikes in Q1. Tech was the other sector very marginally positive (+0.07%) with Nvidia up 1.65% after it released new open-source software aimed at speeding up self-driving cars. Tesla’s November EV registrations in France, Denmark and Sweden halved from a year earlier. The stock was flat on the day.

Asian stocks: Futures are mixed. APAC stocks began the new month mixed, as traders digested the weak Chinese PMI data. The ASX 200 was dragged lower by weakness in healthcare, telecoms, financials and tech, while sentiment was also not helped by the disappointing Chinese data. The Nikkei 225 slipped beneath the 50k level amid a firmer currency and risks of a BoJ rate hike in December. The Hang Seng and Shanghai Comp were kept afloat despite the discouraging Chinese PMI data, in which the headline official Manufacturing PMI continued to show a decline.

Gold jumped north for a third straight day to a high of $4,264 before paring gains through the day. Prices on Friday drove up through a minor fib level (23.6%) of the September break higher at $4,173 which acted as resistance. Fed rate cut bets for a move next week have ticked up into the low 90%s. There is some focus on continued Ukrainian attacked on Russia.

Day Ahead – Eurozone CPI

Consensus forecasts a headline print of 2.1%, unchanged from the October print. Inflation is expected to remain steady in the region around the ECB’s 2% target for the foreseeable future. Services inflation will likely continue to offset downward pressure from the relatively strong euro and producer prices. The core is tracking at 2.4% while services could edge one-tenth higher to 3.5%. This is driven mostly by base effects. Recent countrywide readings were mixed, with Germany and Spain marginally higher while Italy and France were cooler.

The ECB is firmly on hold at present and going into 2026. Sticky inflation around the 2% target does not provide much reason for a rate change in any direction for the moment. The October Minutes emphasised that the ECB will get the 2028 projections for the first time, but policy has less influence at that horizon, which suggests placing more weight on the nearer-term outlook.

Chart of the Day – EUR/USD struggles to build on gains

The world’s most popular currency pair broke above its 50-day SMA at 1.1612 to kick off the final month of the year. That’s the first time it has been above there since mid-October and hasn’t closed above it since early October. Prices also rose above the 100-day SMA at 1.1643, but sellers emerged and the major is back below the 50-day indicator. Near-term resistance also sits at mid-November/late-October highs around 1.1650 with the midpoint of the August to September move at 1.1655. The major Fib below is 1.1592 and the 38.2% at 1.1717.