Stocks gain, bond and bitcoin find some footing

* Wall Street advances with industrials, tech outperforming

* Dollar rebounds versus the yen, euro firmer after inflation data

* Silver falls from record highs, Gold nudges down

* Bitcoin makes full recovery from Monday’s sell-off close to $92,000

FX: USD was quiet as prices tapped the 200-day SMA at 99.63 before staying under this well watched indicator. Newsflow was generally light, but remarks from the US President were in focus. Despite Trump announcing over the weekend that he knew who he’d pick for the Fed Chair Role, he now says he will announce it in early 2026 The move saw a blip of USD strength though this was reversed when Trump said he had narrowed it down to one and even referred to Hassett as ‘potential Fed Chair’ late on. ADP and ISM Services are worth watching today. See more below.

EUR ticked modestly higher in a relatively quiet day. Preliminary euro area CPI data for November was largely in line with expectations, with headline coming in at 2.2% y/y versus 2.1% prior and expected, while core printed 2.5% y/y, unchanged from the previous month. The data offered little to change the ECB from of its neutral stance and no policy change at its meeting in a couple of weeks.

GBP was mid-pack again among the G10 currencies. Domestic releases have been limited to second tier house price data. Comments from Governor Bailey have offered little in terms of guidance as he acknowledged that policymakers were currently assessing the government’s latest budget while highlighting the need to investment and potential growth. Markets have nailed on a 25bps rate cut in two weeks. Another one is priced in by next June. Resistance sits at the 50-day SMA at 1.3263.

JPY pared strength seen on Monday in response to hawkish remarks from BoJ’s Governor Ueda. Fresh drivers were light as continued digestion of Ueda’s remarks has left the yen outlook mixed. Implications for Japan’s bond market may be key again as turbulence was a key factor in forcing the BoJ’s hand to pause back in the second quarter.

US stocks: The S&P 500 added 0.25%, closing at 6,829. The Nasdaq moved higher by 0.84% to finish at 25,556. The Dow settled higher by 0.39% at 47,474. The benchmark broad-based S&P 500 and the Dow are both consolidating in bullish fashion with this week’s price action holding steady after the previous last few days’ strong rebound. The high is the S&P 500 is just above 6,900 and the Dow at 48,431. Industrials, Tech and Communication Services were the only sectors in the green. Energy took another hit with Materials and Utilities all lower by more than 0.7%. Boeing led the winners with a surge above 10% on a forecast of higher jet deliveries and positive free cash flow next year. Intel jumped nearly 9% and hit its highest since April 2024. Amazon announced its new AI chip, which some labelled as rushed but others labelled as a threat to Nvidia. The Amazon AI chip announcement led to downside in US equities, but that later reversed. Salesforce and Snowflake release their results after the US closing bell today.

Asian stocks: Futures are mixed. APAC stocks were mostly in the green as the region shrugged off the weak lead from Wall Street, but with the upside capped amid the absence of any top tier data. The ASX 200 eked mild gains with the help of outperformance in energy, resources and mining, but with gains limited by underperformance in tech and utilities. The Nikkei 225 nursed some of the prior day’s losses but with the rebound contained amid risks of a BoJ December hike. The Hang Seng and Shanghai Comp mostly traded mixed as participants reflected on monthly auto sales updates.

Gold moved lower after three days of gains in a row. The mid-November top is at $4,245. Treasury yields steadied after a sharp sell-off/rise in yields over the past two days, having dipped below 4% on the 10-year.

Day Ahead – Australia GDP, US data

Consensus expects a reading of third quarter growth of 0.7%, a modest one-tenth gain on the prior print. A strong jobs market, softer inflation, tax cuts and better household consumption should have supported activity. In fact, some economists believe the economy is operating near full capacity which is seen in rising underlying core inflation.

US November services ISM is forecast to dip to 52.0 from 52.4. Input costs have recently been driven by tariffs and higher wages, but now reduced political concerns and the government reopening could help sentiment. Prices paid will be watched. Manufacturing PMI slipped further into contraction territory (48.2 from 48.7) with new orders and employment details both unconvincing.

US November ADP Private Payrolls are predicted to come in at 10k, versus the previous 42k. The government shutdown might still be impacting data as the BLS endeavours to catch up on delayed releases. That means this ADP report will fill some of the informational gap that policymakers are contending with. Job creation is likely to be tepid with the chance of a negative number and uninspiring private- sector employment conditions.

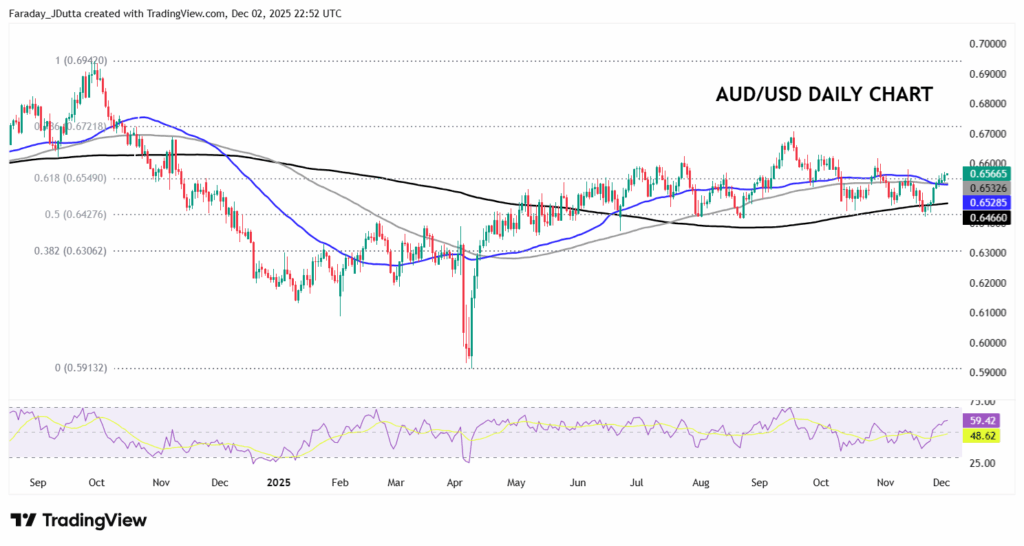

Chart of the Day – AUD/USD picking up momentum

The RBA is not near cutting rates again after recent hotter than expected price pressures. That’s according to CBA and NAB who expect the RBA to be on hold for an extended period of time/foreseeable future. But Westpac continues to expect two 2026 cuts, touting May and August. The bulls have helped the aussie surge seven days in the last eight and above the 50-day and 100-day SMAs. The major has actually been rangebound for some months between the lows 0.64s (the midpoint of the September 2024 to April 2025 move) and around 0.66. The 200-day SMA has acted as support, now at 0.6466. The shorter-term SMAs sit at 0.6528/32 with the September high just above 0.67. Play the ranges with bullish momentum ticking up.