Stocks mixed while dollar halts 9-day losing streak

* Trump to discuss whether to give Nvidia license to export H200 to China

* EUR/USD softens after 8-day rally ahead of US Core PCE

* Meta’s Zuckerberg plans deep cuts of up to 30% for Metaverse budget

* Weekly jobless initial claims lowest in over three years

FX: USD halted the nine-day losing streak, but prices stayed below the 50-day SMA at 99.12 and the mid-November lows. Both initial and continued jobless claims came in below all analyst forecasts, helping ease some recent labour market concerns. That said, the drop has the potential to be a one-off due to poor seasonal adjustment over the Thanksgiving period. There was some worry about Hassett actually doing the job of Fed Chair with apparent questions from inside the central bank.

EUR edged lower but just stayed above the 100-day SMA at 1.1644. As we mentioned yesterday, interest rate differentials are supportive as they reflect expectations for renewed dovishness at the Fed and a neutral policy outlook for the ECB. Yield spreads are up on the week, pushing to fresh 14-month highs and threatening a break to levels last seen in mid-2023.

GBP consolidated Wednesday’s upside move with cable holding just above the 200-day SMA, now at 1.3322. The 100-day SMA sits above at 1.3366. It has been quiet on the UK news front with the implications of last week’s Budget still lingering. Recent BoE comments have been neutral with a rate cut in a couple of weeks largely priced in.

JPY dipped to a fresh two-week low as markets come to terms with a nailed on rate hike by the BoJ in a few weeks. A move of 22bps is priced in after Governor Ueda’s recent comments pushed back against the idea of PM Takaichi dovish tendencies. Three government sources also hinted that it would tolerate such a move.

US stocks: The S&P 500 added 0.11%, closing at 6,857. The Nasdaq moved lower by 0.10% to finish at 25,582. The Dow settled lower by 0.07% at 47,851. Industrials led the way with Tech, Communication Services, Energy and Financials in the green. Health and Consumer Staples were the laggards. Salesforce beat on earnings and revenue guidance and closed 3.6% higher. Snowflake reported weak operating margin outlook and plunged 11.4%. Meta said it was cutting 30% of its budget on Metaverse spending, which gave a boost to its stocks and US indices as the tech giant puts more effort into AI. However, the move was only short-lived for the indices, but Meta still closed with gains of 3.4%.

Asian stocks: Futures are mixed. APAC stocks were mostly higher following the positive momentum from Wall Street. The ASX 200 edged higher in rangebound trade with strength in materials, miners and resources offsetting the losses in the real estate and consumer sectors. The Nikkei 225 rallied above the 50k level as the tech-related momentum in Japan continued, despite higher yields and bets for a December BoJ rate hike. The Hang Seng and Shanghai Comp were mixed amid weakness in auto names and after another liquidity drain by the PBoC.

Gold was steady again as it consolidated recent gains after hitting levels last seen in late October on Monday. Central bank buying remain a constant as we stated yesterday and is expected to underpin prices in the new year.

Day Ahead – US Core PCE, Canada Jobs

The Fed’s favoured inflation gauge is finally released, but it is September data so lagging. The core PCE is expected to rise 0.3% m/m and 2.9% y/y. The FOMC’s most recent median forecast saw the reading at 3.1% in 2025 but cooling to 2.6% next year. The September PPI data, that feeds into these figures could see a modestly softer number as tariff pass-through to consumer goods prices has been gradual. The Fed is in blackout mode ahead of next Wednesday’s FOMC meeting where a 25bps cut is 87% priced in. It’s a very high hawkish bar for data to move the dial on this.

The headline Canada jobs print is expected to see a net negative change of 5,000. The October data was strong with a blockbuster 66.6k jobs added, led by part-time workers. This number, and the September figure of 60.4k, helped offset most of the losses seen in July and August. Those two most recent data points appear inconsistent with a wide range of labour market measures that continue to show weakness. The jobless rate fell to 6.9% from 7.1%. US tariffs have hit economic growth this year.

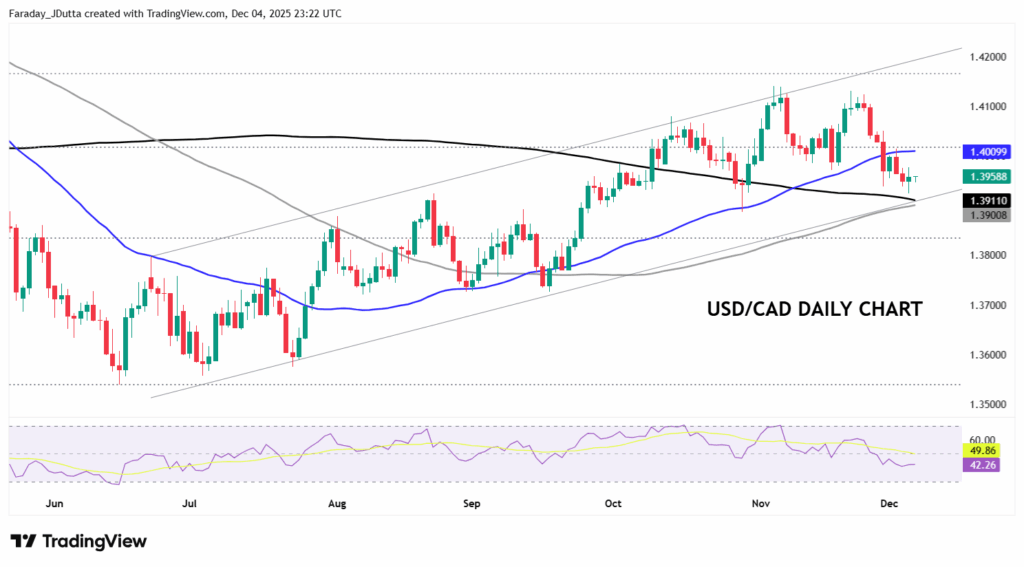

Chart of the Day – USD/CAD downside close to support

The loonie has been helped by several factors in recent weeks. Improved risk appetite, even if background concerns remain, firmer crude prices and also rising copper prices have helped. The latter may give Canadian terms of trade a modest, and CAD-supportive, tailwind. US/Canada rate spreads have narrowed additionally boosting the loonie. The flip side is the rate cutting Fed, and near-term would face a potentially sharp adverse reaction in risk assets should it decide to hold next week. A double top reversal pattern from the November highs sees a measured move downside to around 1.3840. But the 200-day SMA is nearer at 1.3911, with the 100-day at 1.3900. That is also around the bottom of the ascending channel from the June lows. Above, is the 50-day SMA at 1.4009 and a major Fib level (38.2%) of this year’s downtrend at 1.4017.