Getting started in Exchange Traded Funds (ETF) trading may seem daunting for beginners, but it can be surprisingly accessible with the wealth of information and tools available online today. Unlike individual stocks that demand separate research for each company, ETFs allow traders to gain exposure to a basket of stocks or other securities by investing in a single ETF.

Read on to learn all about ETF trading for beginners and understand the ins and outs of ETFs trading.

What is ETF Trading

ETFs are baskets of financial securities managed by a fund manager. There are a variety of ETFs that one can trade such as sector-specific ETFs, bond ETFs, commodity ETFs and stock market index ETFs. ETF trading involves the process of traders buying and selling these various ETF units on stock exchanges, similar to how stocks are traded.

The price of the ETF is determined by the market supply and demand and fluctuates throughout the trading day based on the collective value of the underlying assets. These ETF units can be traded using various trading strategies such as day trading, swing trading, or momentum trading.

Learn more about ETF trading strategies for beginners with our comprehensive article in the Vantage Academy.

With Vantage, you will be able to trade ETFs using contracts for differences (CFDs), that allow you to seize opportunities on the rise or fall in the price of the ETF, without having to own the actual ETF. Interested to start trading ETFs using contracts for differences (CFDs)? Open a live account with Vantage today to begin your ETF CFDs trading journey.

How Do ETFs Work?

An ETF operates like a big basket of securities. When traders purchase units of an ETF, the funds are pooled together by a fund manager, who then uses the funds to replicate the performance of the underlying index it is trying to track by purchasing the stocks within the index. So essentially, when a trader purchases an ETF, they are purchasing a basket of securities, which can be a collection of stocks, bonds, or a mixture of assets managed by a fund manager.

These funds are usually used to track a specific market index such as the S&P 500 and Dow Jones Industrial Average. For other types of ETFs, such as Bond ETFs, Stock ETFs, or sector-specific ETFs, the fund manager allocates the pooled fund to acquire a portfolio that represents the specified ETF theme. For instance, a bond ETF invests primarily in bonds and other debt instruments, while a stock ETF would invest in a broad or specific portfolio of stocks.

A sector-specific ETF, on the other hand, focuses its investments on a particular industry or sector, such as technology, healthcare, or financial services. This allows traders to target their exposure to specific sectors of the market without having to buy individual stocks or bonds in those sectors.

By trading with Vantage, traders can gain exposure to the price movements of an ETF by trading CFDs. Additionally, trading ETF CFDs enables traders to participate in both rising and falling markets, which is one of the unique attributes of CFD trading.

Why Trade ETFs?

ETFs offer a few distinctive advantages for beginners as well as seasoned traders. Here are 3 reasons why some traders choose to trade ETFs.

1. Diversification

ETFs are used to track a specific index or a basket of securities, offering traders easy access to a wide range of financial instruments via a single trade. Through geographical or sector-specific ETFs, traders have the opportunity to diversify their portfolios, broadening their market exposure across different products. This provides traders with an efficient way to diversify their portfolio without having to individually select the financial products.

Just imagine trading the SPDR S&P 500 ETF (SPY), where you’ll gain exposure to popular stocks such as Apple, Microsoft, Nvidia and Tesla in a single trade.

2. Trading Liquidity

ETFs can be readily traded on the stock exchange, just like any other listed stock. This allows them to be traded anytime during market hours, offering a high degree of liquidity. Learn more about market liquidity with our comprehensive article to help you better understand the concept.

3. Transparency

Most ETFs will disclose their holdings on a daily basis. The transparency allows traders to have a clear understanding of the ETF’s full portfolio; this also allows traders to make more informed decisions based on the actual assets held within the ETF. This allows traders to facilitate better risk management and strategic planning.

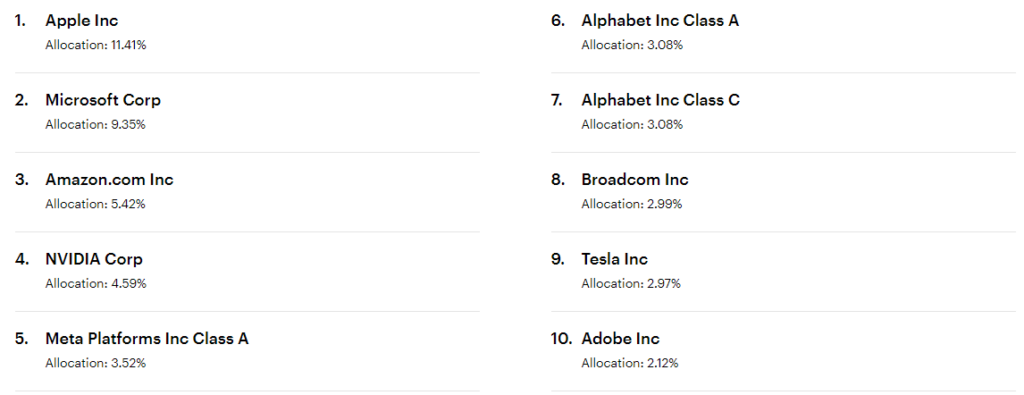

For example, the top 10 holdings within QQQ look like this on 5 September 2023:

Image source: Invesco QQQ ETF

Understand ETFs Trading

Here are some of the things beginners to know when trading ETFs:

Know what moves the ETFs Market

The ETFs market is influenced by the overall supply and demand dynamics of the overall market. The price of ETFs changes based on how many traders want to buy or sell them. If more traders want to buy an ETF than sell it, its price will go up. The market price of an ETF is what it costs to buy or sell a unit during the time the stock exchange is open, and the price will fluctuate throughout the trading day as traders buy and sell the ETF.

Apart from that, macroeconomic factors like interest rates, inflation, and geopolitical events can also cause movements in the ETF market, as they can influence traders’ sentiment and economic outlook.

Learn how to read the charts

An ETF chart is a visual representation of the ETF price performance over time, in minutes, days, weeks, months or even in years. The time progression is plotted along the horizontal axis, and the corresponding ETF prices along the vertical axis. This allows traders to observe the price fluctuations of an ETF within their chosen timeframe, thus giving a snapshot of its historical performance.

Chart reading will help beginners to spot potential trends or patterns which will help them in making strategic trading decisions. This knowledge of reading charts applies to other assets besides ETFs as well.

Ways to trade ETFs

There are various ways a beginner can start ETF trading. One of the most direct approaches is to buy and sell the ETFs on stock exchanges directly.

Derivative instruments, such as CFDs, futures, and options, are also a few choices for traders who are interested in ETF trading.

For example, with Vantage, you can trade ETF CFDs without owning the actual product. Instead, you can trade based the difference between opening and closing prices. This gives you the option to go long (anticipating a rising market) or short (anticipating a falling market) to make the most of bull and bear markets.

Trading ETFs through CFDs also offers the advantage of using leverage, where you can trade larger positions with your existing capital. This can amplify exposure to price movements, both positively and negatively. However, leveraged ETFs come with considerable risk and are not ideal for long-term trading as they can lead to steep losses quickly.

Conventional ETFs and leveraged ETFs require different trading strategies, as the latter is designed for short-term objectives, while ETFs have shown to perform better over the long term. Before trading ETFs through CFDs, it is essential to seek professional advice and fully understand the risks associated with leveraged ETFs.

How to Evaluate the ETFs to Trade

There is a plethora of ETFs products available globally, and here are a few factors that beginners can look into before selecting any ETF to trade:

1. Underlying Index or Asset

Before considering any ETFs to trade, it is important to understand the underlying index or asset classes in which the ETF is tracking or holding. Understanding the underlying assets will give you insights into the ETF’s risk profile, potential returns, and correlation to the overall market.

For example, an ETF tracking the S&P 500 index (e.g. SPDR S&P 500 ETF Trust) will offer more exposure to a broad range of large-cap US stocks, while an ETF such as ARK Innovation ETF is focused solely on disruptive innovation and will be more concentrated in that particular industry.

2. Expense Ratio

The expense ratio of the ETFs is charged by the fund managers, and it is used to cover the work required to research and structure the ETF. It represents the cost of managing the fund and is often expressed as a percentage of the ETF’s total assets.

A lower expense ratio is typically favoured when trading ETFs since it has the potential to affect the overall returns over an extended period.

3. Trading Activity

When evaluating ETFs, it is essential to consider the trading activity of the fund. ETFs with higher average daily volumes typically have more liquid markets, making it easier to buy or sell shares at prevailing market prices. This enhanced liquidity allows investors to swiftly enter or exit positions and potentially capitalise on market opportunities.

Beginner ETFs Trading Tips

There are several trading strategies that beginners can use when trading ETFs. One example is swing trading, which involves capitalising on the price fluctuations of ETFs across various sectors. Another strategy that beginners can utilise is sector rotation, where they need to stay informed about the current economic sectors experiencing robust demand and growth. They can then purchase ETFs related to those sectors to potentially earn returns from their investments.

To learn more about different ETF trading strategies, click here.

Importance of having an ETF trading strategy

Having a well-planned trading strategy is important for beginner traders. It acts as a valuable tool, providing direction and discipline when starting to trade ETFs. By using a clear and well-defined trading strategy, traders can effectively navigate the complexities of ETF trading.

Moreover, ETF trading strategies can also help beginners manage risk effectively. With a strategy to follow, you can set specific entry and exit points to control potential losses and protect your trades. Emotions often lead to impulsive trading decisions and beginners might make costly mistakes. Having a well-planned trading strategy will help reduce such biases and foster a consistent approach to trading.

Key Takeaways for ETFs for Beginners

ETFs offer diversification, enabling novices to include a broad range of assets in their portfolios. For those new to ETF CFDs trading, Vantage offers the opportunity to begin with a demo account, enabling exploration of ETF CFDs trading using virtual credits.

Alternatively, if you are prepared to commence trading ETF CFDs, open a live account with Vantage and embark on your trading journey today.