- Trading

Trading

-

CFD Trading

What is CFD Trading How to Trade CFD Why Trade CFD CFD Trading Strategies

- All Trading Products

-

Markets

All Instruments Forex CFDs Indices CFD Commodities CFD Stocks CFD ETFs CFD Bonds CFD Cryptocurrency CFDs

- Trading Accounts

- Trading Fees

- Trading Leverage

- Trading Server

- Deposit & Withdrawal

- Premium Services

-

CFD Trading

- Platforms

- Academy

- Analysis

- About

-

AllTradingPlatformsAcademyAnalysisAbout

-

Search query too short. Please enter a full word or phrase.

-

Keywords

- Trading Accounts

- TradingView

- Trading Fees

Popular Search

- Trading Accounts

- MT4

- MT5

- Professional Trading Accounts

- Academy

Shares represent small ownership units of a company, giving you a stake in its assets and profits. The term "stocks" is commonly used to refer to shares collectively and is often used interchangeably in finance.

Think of a company as a pizza and its shares as slices. Owning a slice means you have a portion of the pizza, just like buying shares makes you a partial owner of a company. If you own slices from different pizzas, you have a diversified stock portfolio.

However, having a slice doesn’t mean you decide how the pizza is made—similarly, small shareholders don’t control company decisions. Your equity entitles you to a share in the company's value and potential profits, but only after debts are settled.

While this article explains the fundamentals of stocks and shares, it's important to note that Vantage is a CFD broker. CFDs (Contracts for Difference) allow you to trade on the price movements of stocks without owning the underlying asset.

What Does Owning a Stock or Share Mean?

- You own a portion of the company with a claim on its assets and earnings, but only after debts and obligations are settled.

- You may receive a share of the profits (called dividends).

- You may get to vote on important company decisions (like electing the board of directors) but only majority shareholders have significant control over them.

Why Do Companies Sell Stocks?

Companies sell stocks to raise money called capital for things like:

- Expanding their business.

- Developing new products.

- Paying off debt.

Stocks vs Shares: What are the Differences?

The term “stocks” and “shares” are often used interchangeably, but there’s a subtle difference:

- Stocks: Refers to ownership in one or more companies. For example, “I own stock in Apple and Tesla.”

- Shares: Represents a single unit of ownership in a specific company. For example, “I own 10 shares of Apple.”

Example

If you buy 100 units of a company’s stock, you own 100 shares of that company. Think of it like this:

- Stock = The whole pizza

- Shares = The individual slices

How Stocks and Shares Work?

When a company wants to raise money, it can issue shares to the public through an Initial Public Offering (IPO). Once the shares are available, investors can buy them on stock exchanges like the New York Stock Exchange or NASDAQ. By purchasing shares, investors become shareholders, meaning they hold a stake in the company. Shareholders provide the company with capital, which can be used to expand its business, develop new products, or pay off debt. Another way to participate in the stock market is through CFDs. CFDs are leveraged instruments that allow you to speculate on the price movements of stocks, potentially amplifying both gains and losses.

What is an IPO?

An IPO is like a company’s debut on the stock market. Before an IPO, the company is privately owned, often by its founders, early investors or employees. After the IPO, the company becomes publicly traded, meaning anyone can buy and sell its shares on a stock exchange.

As a shareholder, you may have a claim to part of the company’s assets and earnings, but only after debts and obligations are settled. This means you can benefit from the company’s success in two main ways:

- Capital Appreciation: If the company performs well, the value of your shares may increase over time. For example, if you buy a share for $10 and sell it later for $20, you’ve made a $10 profit.

- Dividends: Some companies share their profits with shareholders by paying dividends. For example, if you own 100 shares and the company pays $1 dividend per share, you’ll receive $100.

Not all companies pay dividends. Younger, fast-growing companies (like many tech startups) often reinvest their profits back into the business instead of paying dividends. On the other hand, established companies like Coca-Cola or Procter & Gamble are more likely to pay regular dividends.

Shares can be categorised into public shares and private shares.

| Aspect | Public Shares | Private Shares |

|---|---|---|

| Definition | Shares of companies listed on stock exchanges like NYSE or NASDAQ. | Shares not listed on public stock exchanges. |

| Availability | Available to anyone with a brokerage account. | Usually owned by founders, employees, and private investors. |

| Examples of Companies | Apple, Amazon, Google. | Startups, family-owned businesses, companies like Uber and Airbnb before going public. |

| Purpose of Going Public | Raise large amounts of capital for growth, give early investors a way to cash out, increase visibility and credibility. | Avoid regulatory requirements and costs of being public, maintain control, focus on long-term growth without pressure of quarterly reports. |

| Trading | Shares are traded on the stock market; prices fluctuate based on supply and demand, company performance, and broader economic factors. | Shares are less liquid (harder to buy or sell) since they’re not traded on public exchanges. |

Types of Stocks and Shares Explained

When it comes to stocks and shares, not all are created equal. Different types of stocks serve different purposes and come with varying levels of risk and reward. Understanding these types can help you make smarter investment decisions. Let's dive into the most common categories:

Common vs Preferred Shares

Common shares are the most widely traded type of stock. When people talk about “stocks”, they’re usually referring to common shares.

Example: If you own common shares of Apple, you might have voting rights and the potential to benefit from both dividend payments and price appreciation.

Preferred shares are a bit different. They're often considered a hybrid between stocks and bonds because they offer most stability but less growth potential.

Example: If you own preferred shares of Coca-Cola, you might receive a steady 5% dividend annually, but you won’t have a say in company decisions.

Differences between common and preferred shares.

| Feature | Common Shares | Preferred Shares |

|---|---|---|

| Voting Rights | Yes | No |

| Dividends | Not guaranteed | Guaranteed and fixed |

| Growth Potential | High | Low to moderate |

| Risk Level | Higher | Lower |

| Priority in Liquidation | Lower priority | Higher priority |

Growth vs Value Stocks

Growth stocks belong to companies that are expected to grow faster than the overall market. These companies often reinvest their profits into expanding their business rather than paying dividends.

Example: If you invested in Amazon during its early days, you would have seen massive growth as the company expanded from an online bookstore to a global e-commerce giant.

Valuable stocks are shares of companies that are considered undervalued by the market. These companies are often well-established but may be overlooked by investors.

Example: Procter & Gamble (P&G) is a classic value stock. It's a well-established company with strong fundamentals and a history of paying consistent dividends.

Differences between growth and valued stocks.

| Feature | Growth Stocks | Value Stocks |

|---|---|---|

| Growth Potential | High | Moderate |

| Risk Level | Higher | Lower |

| Dividends | Rare | Common |

| Company Stage | Young, fast-growing | Established, stable |

| Example Industries | Tech, biotech, renewable energy | Utilities, consumer goods, banking |

Blue-chip vs Penny Stocks

Blue-chip stocks are shares of large, well-established companies with a history of stable performance. They're called “blue-chip” because they’re considered reliable and high-quality.

Example: If you buy shares of Microsoft, you’re investing in a company with a proven track record of innovation and profitability.

Penny stocks are the opposite of blue-chip stocks. They're shares of small, often speculative companies that trade for less than $5 per share.

Example: A penny stock might be a small biotech company developing a new drug. If the drug gets approved, the stock price could skyrocket. But if it fails, the stock could become worthless.

Differences between blue-chip and penny stocks.

| Feature | Blue-chip Stocks | Penny Stocks |

|---|---|---|

| Risk Level | Low | High |

| Liquidity | High | Low |

| Dividends | Common | Rare |

| Company Size | Large, established | Small, speculative |

| Example Companies | Coca-Cola, Microsoft | Tilray Inc., Nikola Corporation |

Public vs Private Shares

Public shares are those of companies that are listed on stock exchanges and available for anyone to buy and sell.

Example: If you buy shares of Tesla, you’re investing in a public company whose stock price is influenced by market trends, company performance and investor sentiment.

Private shares are those of companies that are not listed on public stock exchanges. These shares are typically owned by founders, employees or private investors.

Example: Before going public, companies like Uber and Airbnb raised billions of dollars by selling private shares to investors. These investors hoped to profit when the companies eventually went public.

Differences between public and private shares.

| Feature | Public Shares | Private Shares |

|---|---|---|

| Availability | Available to everyone | Limited to accredited investors |

| Liquidity | High | Low |

| Transparency | High (regulated) | Low |

| Risk Level | Moderate | High |

| Example Companies | Apple, Amazon | SpaceX, pre-IPO startups |

Why Do Share Prices Fluctuate?

Understanding why shares prices fluctuate is crucial for investors looking to navigate the stock market effectively. Several key factors influence stock prices, ranging from company-specific events to broader economic trends. By examining these factors, investors can gain insights into market dynamics and make more informed decisions.

Key Factors Affecting Stock Prices

- Supply and Demand: The fundamental principle of supply and demand dictates that when there are more buyers than sellers, stock prices rise and when there are more sellers than buyers, prices fall.

- Company Earnings: A company’s financial performance, particularly its earnings, plays a crucial role in determining its stock price. Strong earnings report often lead to higher stock prices as they indicate the company’s profitability and growth potential. Conversely, disappointing earnings can lead to a decline in stock prices.

- Economic Trends: Broader economic factors such as interest rates, inflation and global events also impact stock prices. For example, rising interest rates can make borrowing money more expensive, reducing corporate profits and leading to lower stock prices. Similarly, economic recessions can decrease consumer spending and business investment, negatively affecting stock prices.

- Investor Sentiment: Market sentiment, influenced by news, rumours or social media, can cause significant fluctuations in stock prices. For instance, a positive tweet from a high-profile individual like Elon Musk can boost investor confidence and drive-up stock prices, while negative news can have the opposite news.

Case Study: Elon Musk’s Tweet

In 2020, Elon Musk tweeted about Tesla, stating, “Tesla stock price is too high imo.” This tweet caused a significant drop in Tesla’s stock price, dropping as much as 12% Friday before closing 10.3%, demonstrating how influential investor sentiment can be [1]. *

* This example demonstrates the potential impact of social media, but it is crucial to understand that social media is not a reliable source of investment advice. Always conduct thorough research from reputable sources before making any investment decisions.

How Global Events Impact Share Prices

Global events can have profound effects on stock markets, often leading to increased volatility and significant price fluctuations. Here are a few examples:

- Economic Recessions: During economic downturns, consumer spending and business investments typically decline, leading to lower corporate earnings and consequently, lower stock prices. The 2008 global financial crisis is a prime example, where stock markets around the world experienced sharp decline due to widespread economic instability.

- Interest Rate Changes: Central banks, such as the Federal Reserve, adjust interest rate to control inflation and stabilise the economy. When interest rates rise, borrowing costs increase, which can reduce corporate profits and consumer spending, leading to lower stock prices. Conversely, lower interest rates can stimulate economic activity and boost stock prices.

- Geopolitical Events: Political instability, wars and trade disputes can create uncertainty in the markets, leading to increased volatility. For instance, the trade tensions between the US and China have historically caused fluctuations in global stock markets as investors react to the potential economic impact.

Trading vs Investing Stocks: What’s the Difference?

When it comes to the stock market, there are two main approaches: investing and trading. While both involve buying and selling stocks, they differ significantly in terms of goals, timeframes and strategies. Understanding these differences is crucial for deciding which approach aligns with your financial goals and risk tolerance.

Long-Term Investing vs Short-Term Trading

Investing is all about buying and holding stocks for the long-term – typically years or even decades. The goal is to build wealth gradually by benefiting from the company’s growth over time. Investors focus on companies with strong fundamentals, such as stable earnings, competitive advantages and growth potential. However, past performance is not indicative of future results.

Trading, on the other hand, involves buying and selling stocks frequently to profit from short-term price movements. Traders aim to capitalise on market volatility rather than long-term growth. They use tools like technical analysis, charts and market trends to identify short-term opportunities. For example, a trader might buy shares of Tesla at $700 and sell them a week later at $750, making a $50 profit per share. However, this is a simplified example, and actual market conditions will vary. Trading can also be done using Contracts for Difference (CFDs). As a CFD broker, Vantage offers trading through CFDs.

Ready to get started on your trading journey via CFDs? Open a live account with Vantage today and get started with a library of free resources to fuel your learning journey!

So, when do you choose to invest or trade?

An individual saving for retirement may invest in a diversified portfolio of stocks and bonds for steady long-term growth. On the other hand, someone looking for more immediate returns may engage in active trading, aiming to capitalise on short-term market fluctuations and take advantage of timely opportunities.

What are the Risks and Benefits of Investing vs Trading

Investing offers steady returns over the long term. One of the key benefits of investing is the potential for compounding returns, where reinvested dividends and capital gains grow exponentially over time. Additionally, investing requires less time and effort compared to trading, making it a more passive approach. However, investing does come with risks. Market downturns can affect portfolio value in the short term, and it requires patience, as returns may take years to materialise.

Trading, while offering the potential for quick profits, comes with higher risks. The use of leverage in trading can amplify both gains and losses, making it a high-stake approach. Traders need to be skilled at analysing market trends and making quick decisions, as even small mistakes can lead to significant losses. Additionally, trading requires significant time and effort to monitor the markets and manage trades.

How to Trade Stocks?

Trading stocks can seem intimidating at first, but once you understand the basics, it becomes much more approachable. There are two main ways to trade stocks:

- Buying actual shares

- Trading CFDs

Buying Actual Shares vs Trading CFDs

When you buy actual shares, you are purchasing a portion of ownership in a company. This method is typically associated with long-term investing. Shareholders benefit from dividends and have voting rights in the company.

On the other hand, trading Contracts for Difference (CFDs) allows you to speculate on the price movements of shares without owning the underlying asset. CFDs offer the advantage of leverage, enabling you to control larger position with a smaller amount of capital, but they also come with higher risks and do not provide dividends or voting rights.

Difference Between Owning Shares vs Trading CFDs

| Feature | Owning Shares | Trading CFDs |

|---|---|---|

| Ownership | You own a portion of the company. | You don’t own the underlying asset. |

| Dividends | Eligible to receive dividends. | Not eligible for dividends. |

| Voting Rights | Yes | No |

| Investment Horizon | Best for long-term investors. | Popular for short-term trading. |

| Profit Mechanism | Gain from share price appreciation and dividends. | Profit from price movements (both up and down). |

| Leverage | No leverage – full capital required. | Uses leverage to trade larger positions with less capital. |

| Risk | Limited to the amount invested. | Higher risk due to leverage, which amplifies losses. |

| Market Direction | Only profitable if the stock price rises. | Can profit from both rising and falling prices. |

Advantages of CFD trading

- Leverage: CFDs provide higher leverage than traditional stock trading, allowing traders to control larger positions with less capital.

- Flexibility: CFDs enable traders to go long (buy) or short (sell) on stocks, providing opportunities to profit in both rising and falling markets.

- Lower Costs: Trading CFDs often involves efficient use of capital compared to buying actual shares, as there are no stamp duties or physical ownership fees.

- Access to Global Markets: CFD brokers offer access to a wide range of global markets from a single platform, allowing traders to diversify their portfolios.

Risk Reminder: CFDs are complex instruments that come with a high risk of losing money quickly due to leverage. Traders are encouraged to always trade within their means.

How to Trade Stocks via CFDs with Vantage

Vantage offers a user-friendly platform for trading CFDs on various markets, including stocks, forex, commodities and indices. Here are the steps to get started:

1. Create an Account

Open a Live Account with Vantage. Once you’ve opened an account of your own, choose between MT4 or MT5 trading platforms, select your account type and choose your account currency.

2. Fund Your Account

After opening your account, you’ll need to deposit funds. Vantage offers multiple payment methods including bank transfers, credit/debit cards and e-wallets. Choose the method that is most convenient for you.

3. Analyse the Markets

Before placing a trade, it’s important to analyse the market. Determine which products you wish to trade. Vantage offers stocks via CFDs from well-known companies including Apple, Amazon, Tesla and more. Use technical analysis and fundamental analysis to make informed decisions. Take advantage of Vantage’s free resources like the academy page, market analysis and tools to boost your trading journey.

4. Open and Monitor

Once you’ve analysed the market, it’s time to place your trade. Decide whether to buy or sell. Set your position size and for trading CFDs, choose your leverage level.

5. Monitor and Close

After placing your trade, monitor its performance. Use tools like stop-loss orders and take profit orders. When you’re ready, close your trades.

Explore More About Stock Trading

-

WHY TRADE STOCKS CFDs

Find out the unique benefits and advantages that trading stocks can offer, and why the stock market has such enduring appeal among the investing community.

-

How to Trade Stocks CFDs

Learn how to open a trade, set stop-losses, and manage risk.

-

Stock Trading Strategies

Discover various stock CFD trading strategies that can help improve your trading skills.

Award-Winning Broker

-

Best Broker

AustraliaInternational Business Magazine

-

Best Customer

Support AustraliaInternational Business Magazine

-

Best Overall Broker –

AustraliaInternational Business Magazine

Trade Stock CFDs On Different Types of Trading Platforms

MetaTrader4

- 30 built-in technical indicators

- 31 analytical charting tools

- 9 time-frames

- 4 types of trading orders

MetaTrader5

- 38 built-in technical indicators

- 44 analytical charting tools

- 21 time-frames

- 6 types of trading orders

TradingView

- 15+ chart types

- 100+ in-built indicators

- 50+ drawing tools

- 12 alert conditions

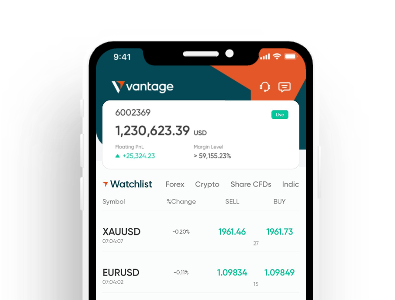

Vantage Mobile App

- 55 deposit methods globally

- 220+ daily product analysis

- 16 TradingView indicators

- 80,000+ copy traders

Choose a Trading Account Based on Your Experience Level

-

1

Beginner Traders

-

2

Experienced Traders

-

3

Professional Traders

High Volume Traders

- For traders looking for low and competitve commission, with only $1 per standard FX lot per side.

-

1

Register

Quick and easy account opening process.

-

2

Fund

Fund your trading account with an extensive choice of deposit methods.

-

3

Trade

Trade with spreads starting as low as 0.0 and gain access to over 1,000+ CFD products.

Frequently Asked Questions

-

1

Are stocks and shares the same?

While often used interchangeably, “stocks” refer to ownership in one or more companies, while “shares” represent a single unit of ownership in a specific company. -

2

Which stock is best to trade?

The best stock depends on your goals and risk tolerance. Blue-chip stocks are safer, while penny stocks offer higher risk and reward. -

3

Is trading stock CFDs risky?

Yes, trading stock CFDs involves risk, but the level of risk depends on your approach.

At Vantage, we encourage clients to start small and use risk management tools like stop-loss orders to limit potential losses. Additionally, our demo account allows you to practice trading with virtual funds before risking real money. -

4

How much do I need to trade stock CFDs?

The amount you need to start trading stock CFDs varies depending on the platform and the type of trading you choose. You can start trading stocks through CFDs with as low as $0 commission*.

*Other fees may apply. -

5

How much stock CFDs should I buy as a beginner?

As a beginner, it’s important to start small and diversify your portfolio to minimise risk.

[1] “Tesla shares tank after Elon Musk tweets the stock price is ‘too high’ - CNBC.” https://www.cnbc.com/2020/05/01/tesla-ceo-elon-musk-says-stock-price-is-too-high-shares-fall.html.

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Ensure you understand how CFDs work and whether you can afford to take the high risk of losing your money. The information is provided for educational purposes only and doesn't take into account your personal objectives, financial circumstances, or needs. It does not constitute investment advice. We encourage you to seek independent advice if necessary. The information has not been prepared in accordance with legal requirements designed to promote the independence of investment research. No representation or warranty is given as to the accuracy or completeness of any information contained within. This material may contain historical or past performance figures and should not be relied on. Furthermore estimates, forward-looking statements, and forecasts cannot be guaranteed. The information on this site and the products and services offered are not intended for distribution to any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.