Bullion, Bitcoin battered, Amazon slumps on jumbo AI capex

* Wall Street slides for third straight session, S&P500 taps 100-day SMA

* Silver and bitcoin fell sharply as tech selling and positioning impact

* Amazon falls over 8% after hours after forecasting 50% capex surge to $200bn

* Glencore Rio abandoned their merger talks for a third time

FX: USD advanced to 2-week highs and the December 24 low at 97.74. Weak risk sentiment helped with politics weighing on some of its peers like the yen and sterling. The crypto plunge has added to the damp mood with bitcoin falling over 13.7% to levels last seen in October 2024. JOLTs job vacancy data showed weaker openings than forecast with the lowest print since September 2024 and a bad revision. We remind readers that NFP gets released next Wednesday 11th and US CPI next Friday 13th.

EUR threatened to break down versus the greenback as the ECB delivered a no change, “steady as she goes” meeting. Policymakers are sitting in a good place with inflation around 2% and growth expected around potential. That said, there is a risk of an inflation undershoot if we get more euro strength or market volatility. President Lagarde also didn’t stick to well-known phrases like data dependency and not pre-committing. Concerning euro strength, she stressed the current level was broadly in line with the historical average. Near-term support is around 1.1775.

GBP was the big laggard as the Bank of England very much surprised with a dovish stance. The vote was 5-4, somewhat different to the consensus 7-2 so heavily divided with four members of the MPC wanting another rate cut at this meeting. New analysis contained in the MPR stated that wage growth around 3.25% is consistent with 2% inflation. All in, if the data follows recent trends of softer employment and earnings and easing inflation, a March rate move is on the cards. It may all come down to Governor Bailey’s vote again. Markets see a 63% chance of March reduction, with 46bps priced in for 2026, up from roughly 35bps before the meeting. We’re also watching gilt markets as political turmoil, and the possible fall of PM Starmer gets louder.

JPY outperformed among its peers, printing small down which meant the major is still on a five-day win streak. The yen is down over 3% since hitting 152.09 last week. PM Takaichi is widely expected to win a strengthened mandate at Sunday’s election, allowing her to deliver on her platform of fiscal stimulus and tax cuts, complemented by greater cooperation with the BoJ. The bond market is looking on with some trepidation though some of this should be priced in.

US stocks: S&P 500 lost 1.23% to close at 6,798, the Nasdaq was down 1.38% at 24,549 and the Dow Jones was lower by 1.2% at 48,909. Utilities was the only sector in the green with Materials, Consumer Discretionary and Technology the leading losers. Wall Street’s fear gauge, the VIX index, jumped up to above 21. Big Tech valuations were again questioned with Meta the only Mag 7 positive while Microsoft was down 5% and Tesla off 2.2%. The Mag7 is now just 3% higher than the overall index since the start of last year. Chipmakers also joined the battered software sector with big losses, while Qualcomm lost 8.4% on weak next quarter outlook amid a global memory shortage. Amazon stocks slumped by as much as 10% at one point after hours, as it prepared a $200bn AI spending blitz, roughly a third more than forecast to $200bn.

Asian stocks: Futures are mixed. APAC stocks were mostly lower following the continued tech selling stateside while commodities were pressured overnight with silver plunging by a double-digit percentage. The ASX 200 was dragged lower by mining and resources, but losses were offset by gains in financials and consumer stocks. The Nikkei 225 saw early indecision but eventually slipped below the 54,000 level as it confirmed to the downbeat mood. The Hang Seng and Shanghai Comp fell with notable weakness in miners, property names and insurers, with reports of an ‘excellent’ call between Trump and Xi failing to lift risk appetite.

Gold volatility continued as markets continued to adjust positioning following the recent moves. Silver sold off over 19% as talk about a huge Chinese short position lingered over dip buyers. We have said before how gold’s little brother is prone to wild two-way moves, owing to the relative small size of its market, physical shortage and industrial demand.

Day Ahead – Canada Jobs

Job gains are expected to have remained muted in January with the headline figure forecast to print modestly positive at 5,000. That’s marginally below the prior 10,100. The jobless rate is seen steady at 6.8%. The BoC appears comfortable with its current stance with little change forecasts through this year.

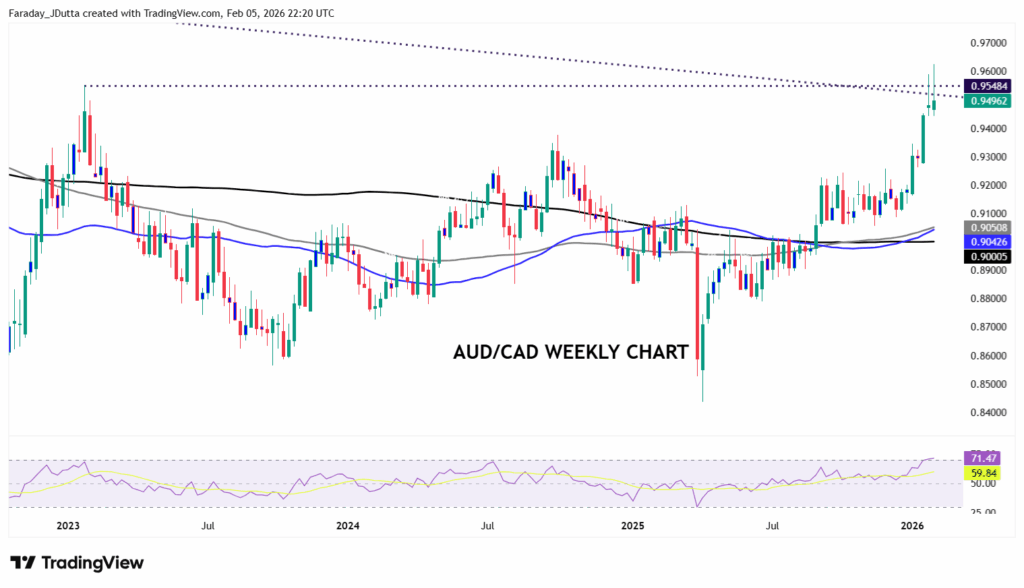

Chart of the Day – AUD/CAD hits long-term resistance zone

The bullish break above multi-year (post-pandemic) highs and major bear trend resistance around the low 0.95 area has stalled. The cross had tracked sideways in a bullish consolidation pattern in mid-January before breaking out to the upside in line with the dominant trend. That pushed up past the September 2024 high at 0.9375 and into January 2023 highs. But bullish momentum signals have become stretched. Buyers now needs to extend gains through the 0.9550 area and hold them over the next few weeks to underpin prospects for a further run higher, potentially towards February 2021 highs around 0.99/1.00. Support is around 0.9375.