Hot data helps dollar as precious metals sinks again

* Dollar jumps again as strong data adds support

* Latest US government shutdown will delay Friday’s January NFP report

* S&P 500 rebounds near to record highs with focus on earnings

* Gold and silver shake-out from melt-up continues though dip buying seen

FX: USD firmed strongly for a second straight day with prices getting above the long-term trendline which taps the 2011 and 2021 lows. Fed Chair nominee Warsh is boosting the buck as bulls like a more market friendly and inflation fighting former Fed governor. Relief from a more dovish choice is also helping. Better than expected ISM Manufacturing saw the 10-yield US Treasury yield bounce off the 200-day SMA at 4.23%. The headline moved above 50 for the first time in 12 months and was the biggest expansion since 2022. Note that given the partial government shutdown, the BLS have delayed the January NFP report due Friday and the December JOLTS report due Tuesday.

EUR fell quite sharply again as the major moved further below the September top at 1.918. A neutral outlook is expected from Thursday’s ECB meeting as policy is in a good place and inflation around the 2% target. The 50-day SMA sits below at 1.1708 as yield spreads have started to recover and move positively in favour of the single currency versus the dollar. Initial support could be around the December highs just above 1.18.

GBP outperformed as cable printed a doji. Focus is on this week’s BoE meeting on Thursday which will see rates left unchanged but updated forecasts and an interesting MPC vote split. Markets have erased easing bets in recent weeks with another quarter point cut not now priced in until June and less than 40bps in total by year-end.

JPY underperformed as it gave back more of last week’s gains. The 50-day SMA sits above at 156.27. Comments from PM Takaichi were also negative for the yen as she talked up the positive benefits of a weaker currency. Recent polls point to a landslide victory for her party at Sunday’s snap election. The PM’s call for closer govt/BoJ cooperation has also been a worry for markets, causing major weakness Japanese government bonds.

US stocks: S&P 500 added 0.54% to close at 6,976, the fourth highest close in history, the Nasdaq was up 0.73% at 25,739 and the Dow Jones was higher by 1.05% at 49,408. Consumer Staples, Industrials and Financials led the way. Energy, Utilities, and Real Estate were the only sectors in the red, with the former weighed by losses in WTI and Brent, down more than 5% on the day. Energy was heavily sold as the US/Iran rhetoric eased, after weeks of escalating tensions. Oracle plans to raise $50 billion to expand its cloud infrastructure. The stock initially jumped 5% on the open but eventually closed lower, down 2.75%. Disney slumped 7.4% as the top and bottom line beat estimates, but its theme parks reported a drop in visitors, and TV and film division earnings dropped. Nvidia slid 0.9% after it said plans to invest up to $100bn in OpenAI to support AI models had stalled after internal doubts.

Asian stocks: Futures are mixed. APAC stocks were sold amid weak China PMIs and poor sentiment driven by the metal meltdown. The ASX 200 underperformed as mining tumbled after the biggest intraday gold drop in four decades. The Nikkei 225 initially held up on the weaker yen and strong polling by PM Takaichi, but losses came through the day. The Hang Seng and Shanghai Comp suffered on disappointing PMIs.

Gold was again volatile with more selling and intraday losses of as much as 10% in the Asian session. But prices rebounded off the 50-day SMA at $4,469 and the October highs at $4,380. More leveraged forced selling, a stronger dollar, reduced tension between Iran and the US and profit taking all did for bullion, though dip buyers helped push losses to ‘only’ around 5%. Silver had similar price action.

Day Ahead – RBA Meeting

The first RBA meeting of the year is expected to bring with a first rate hike of 25bps in more than two years, taking the cash rate to 3.85%. The bank kept policies unchanged in December for a third straight meeting as expected, but there was a hawkish tone to Governor Bullock’s press conference. She said persistent inflation would raise policy questions without putting a timeline on any move, and flagged inflation and jobs data as key inputs for today’s meeting. Recent data have supported a hike with resilient and still tight labour market data, and elevated services inflation above the 2-3% RBA target range. Key will be the tone and guidance for the next hike, with consensus seeming to think policymakers will be relatively cautious, trying to balance up support for growth and containing stubborn inflation.

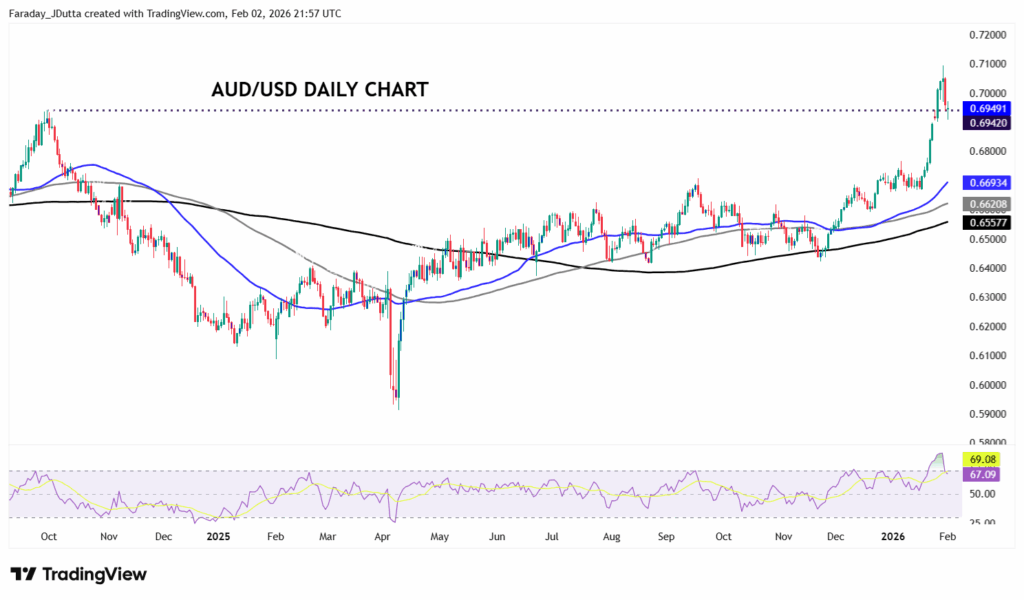

Chart of the Day – Overbought AUD off highs

We talked often on the weekly webinar about how AUD/USD had been trading in a range for some time (0.64 to 0.66 give or take) and that often means the breakout will be strong when it comes. Typically, that is in line with the longer-term dominant trend. After pushing up through 0.66 in early December, prices then traded up around the September high within a relatively tight range. We then got range expansion in line with the uptrend and a sharp breakout above September 2024 highs at 0.6942 to a peak of 0.7093 last seen three years ago. But overbought conditions have reversed over the past few sessions as the major reverts back to that September 2024 top. Consolidation after nine days of straight buying is healthy and logical. But if we do lose this initial support, then next level below sits just above 0.68.