More fresh record stock highs post-NVDA results

* S&P 500, Dow post record closes as Nvidia results buttress AI rally

* Dollar weakens as September Fed rate cut bets grow

* Gold rises to five-week high on soft dollar and Treasury yields

* Fed’s Cook suggests “clerical error” was behind mortgage dispute

FX: USD dropped for a third day in a row, after the 100-day SMA capped the upside on Wednesday. The outside range day last Friday didn’t kick off a breakdown straight away, but the August low sits not far away at 97.55. US initial jobless claims came in line more or less while the second estimate of US GDP was revised two-tenths higher to 3.3%.

EUR attracted buyers and moved just above its 50-day SMA at 1.1658. Easing political worries in Europe have brought a sigh of relief in markets. France’s PM is making a major effort to negotiate with lawmakers ahead of his own September 8 confidence vote. Notably, German-US short-end yield spreads are close to highs last seen in April. The ECB minutes confirmed its wait-and-see stance, though with an easing bias.

GBP underperformed most of its peers but closed above its 50-day SMA at 1.3492. Yield spreads between the UK and US continue to help sterling, with shifting Fed expectations the major driver. Bulls will aim for the August highs just below 1.36.

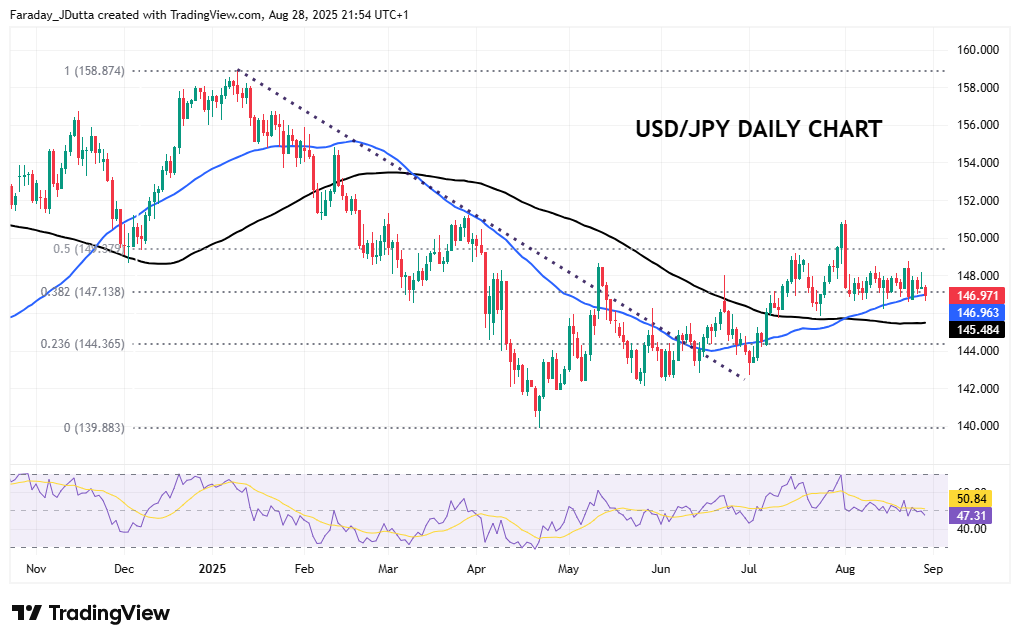

JPY touched the 50-day SMA is acting as support at 146.96. The latest speech from a BOJ official was hawkish as she highlighted reduced trade policy uncertainty and an improvement in the environment for a rate hike.

AUD outperformed as it brushed off disappointing Q2 capex figures. Prices on the major closed higher, above the 50-day SMA at 0.6513 for the first time in two weeks. CAD was mid-pack in the majors. The major moved down through its 100-day SMA at 1.3767. Narrowing spreads between the US and Canada are hitting multi-month lows as US Treasury yields slide.

US stocks: The S&P 500 printed up 0.32% at 6,501. It was a second record close in as many days, the 20th of 2025. The Nasdaq settled up by 0.58% at 23,703. The Dow Jones finished higher at 45,636, a record close adding 0.16%. Seven sectors rose with Communication Services, Energy and Tech leading the gainers and Utilities the weakest sector. Nvidia printed a doji candle and finished lower by less than 1% after its quarterly earnings released after the closing bell on Wednesday. Potential China sales were excluded from its quarterly forecast due to China-US trade uncertainties. The bottom- and top-line numbers, especially data centre revenues, were still impressive even if slightly underwhelming investors. HP rose 4.6% after beating revenue estimates on increasing demand for AI-powered PCs.

Asian stocks: Futures are mixed. Regional markets were mostly higher post-Nvidia’s earnings and investors mild disappointment, with questions around China chip sales. The ASX 200 was muted with more company results to digest. The Nikkei 225 eked out gains in quiet trade. The Hang Seng and Shanghai Composite traded mixed with the former underperforming due to poor Meituan earnings, and one eye on updates from China’s biggest lenders.

Gold pushed higher for a third straight day and above the falling trendline from the record high at $3,500 seen in April. Falling Treasury yields and the dollar are helped gold bugs, with questions around Fed independence still lingering.

Day Ahead – Japan data and US Core PCE

We get a bunch of Japanese data including retail sales, unemployment and Tokyo CPI inflation. Following the recent better-than-expected growth figures for Q2 and some modest pick-up in private spending, July retail sales will be of interest. Inflation remains a headwind for consumers with food prices as the key driver. Tokyo data will show if this trend continues, with the core expected to stay above 3%.

The Fed’s favoured inflation metric is forecast to remain steady at 0.3% m/m in July. Economists will watch the print to a few decimal places. That lifts the annual rate one-tenth to 2.9%. Components from CPI and PPI that feed into this data saw modest increases. It all points to cost pressures mounting in the supply chain, which consumers may have to shoulder soon as companies eventually pass these on to them. There are mixed views on the FOMC regarding inflation, with some saying tariffs will only cause a one-time price level rise while others are more worried about persistently elevated inflation.

Chart of the Day – USD/JPY tracking sideways, waiting to break

US Core PCE will impact this major, though markets may possibly be waiting for the more important NFP report next Friday. This comes after Fed Chair Powell stressed he was now more worried about the job market than high tariff-induced inflation. Of course, Japan data could also affect the yen, with currently just below a coin flip’s chance of an October BoJ rate hike. The BoJ may also be interested in hiking rates in order to stabilise the long end of the Japanese government bond market, where long-end yields recently hit multi-decade highs. This all contrasts with the Fed who is expected to ease next month and contonue to do so in the upcoming quarters.

The 50-day SMA is acting as support initally, at 146.98 with the 100-day below at 145.48. Prices are currently trading around a major Fib level of this year’s decline, at 147.13. The midpoint of that move is 149.37. The daily RSI is marginally bearish and a more meaningful decline would see a potential sharp breakdown.