Risk-off as gold melt-up goes big and bonds go bid

* Wall Street ends lower as financials drag on indices

* Gold through $4,300 supported by rate cuts and haven bid

* Dollar continues to fall amid focus on trade dispute and rate outlook

* US regional banking woes hits risk sentiment with havens supported

FX: USD sold off through the US session as prices hit the downward trendline from the May and August highs. That could offer initial support ahead of the 100-day and 50-day SMAs at 98.12 and 98.03. Markets remain focused on the US-China trade frictions and whether this is merely a negotiating tactic by President Trump or a genuine intention to squeeze the Chinese economy. The same could be said on the other side for China and their ramping up of official comments. Jitters over US regional banks also hit the greenback, which came on top of Frist Brand and Tricolor bankruptcies. Money markets now see the October and December Fed meeting more than fully priced for a 25bps rate cut each, with a total of 69bps priced in for January, versus 62bps on Wednesday.

EUR rose for a third straight day, pushing above the 100-day SMA at 1.1648 and a major Fib level of the August to September move at 1.1592. The 50-day SMA is near, at 1.1692. France/Germany yield spreads are steady, reflecting French PM Lecornu’s success in passing the first of two no-confidence votes. ECB comments continued to emphasise the bank’s neutral stance on rates, and the market’s pricing of a policy hold into 2026.

GBP performed mid pack in the majors after August GDP printed in-line at 0.1%. The prior reading was revised one-tenth lower to -0.1%. The 50-day and 100-day SMAs sit above at 1.3473 and 1.3486.

JPY fell for a third day as it outperformed. We wrote earlier in the week about the big bearish ‘outside day’ from last Friday. Hawkish comments from the BoJ have confirmed recent messaging around policy tightening,though markets only price in around 4bps of rate hikes for the end of October meeting. The domestic political situation remains unclear with LDP leader Takaichi scrambling to form an alliance with the Innovation Party to secure her position as PM. The yen also benefitted from the risk-off environment.

AUD underperformed after a mixed job report saw the unemployment rate tick up to the highest level since November 2021. But a higher participation rate offers part of a reason. RBA rate cut odds sit around 70%. CAD lost ground versus the dollar as prices consolidated below the Tuesday spike high at 1.4080.

US stocks: The S&P 500 lost 0.63% to close at 6,629. The Nasdaq moved lower by 0.36% to settle at 24,657. The Dow Jones finished at 45,952, down 0.65% on the day. Only Technology stayed in the green, up just 0.13%, while Financials took the worst hit (-2.75%) as regional banking stress ramped up. Energy and Utilities also underperformed, down over 1%. Fraud hit regional banking names as problems at Western Alliance and Zion Bancorp increased credit fears. The VIX, Wall Street’s fear gauge, jumped up above 25. Its long-term average is around 17. Consumer sensitive stocks also got hit on concerns over credit, which have been heightened following the collapse of auto parts supplier First Brands and car dealership Tricolor.

Asian stocks: Futures are mixed. Stocks traded broadly higher in spite of choppy trading on Wall Street. The ASX 200 made fresh record highs amid softer yields and a rise in unemployment. The Nikkei 225 pushed up above 48,000 again and looked through hawkish BOJ comments and soft machinery orders data. The Hang Seng and Shanghai Comp lagged with weakness in Chinese tech amid ongoing trade ructions.

Gold marched higher to a new top at $4,330, with the precious metal up 7.7% this week and nearly 12.2% this month. It is now the most overbought on the monthly RSI in more than 52 years. Comparisons to the 1980s price peak may be wide of the mark as bugs proclaim that bullion benefits from its role as both a risk diversifier and strategic asset. Those structural drivers, they say, are expected to underpin support for elevated prices. UBS, the Swiss investment bank, sees the decline in real rates, potentially into negative territory, further boosting the portfolio appeal of gold, which it says could rise towards UBS’ upside call of $4,700.

Day Ahead – End of a choppy week…

We’ve used the word ‘choppy’ a few times this week to describe price action in stocks and markets more broadly. US stock indices are currently printing a weekly doji candle which sums this up, while the week’s range has been within last week’s – an ‘inside’ candle which denotes indecision!

The ‘wall of worry’ includes the obvious flare-up in US-China trade tensions, stretched valuations and seasonal weakness. Overcrowded bullish, and fairly complacent positioning has added to headwinds, while the lack of US economic data leaves markets in wait-and-see mode. US CPI is set to be released next week but markets are baked in for more Fed rate cuts. We expect a lot of trade war noise to continue into the start of November, which means this price action may endure for a few more weeks. We note the WSJ story about China betting a hit on the US stock market will cause Trump to cave in negotiations.

Soft data would help cement policy easing and a risk move higher, especailly if US-China tensions cool. All that said, the latest credit concerns around various small banks in the US adds another dimension to the current environment. Some profit taking on a Friday at the end of the week seems highly possible, with this a developing story.

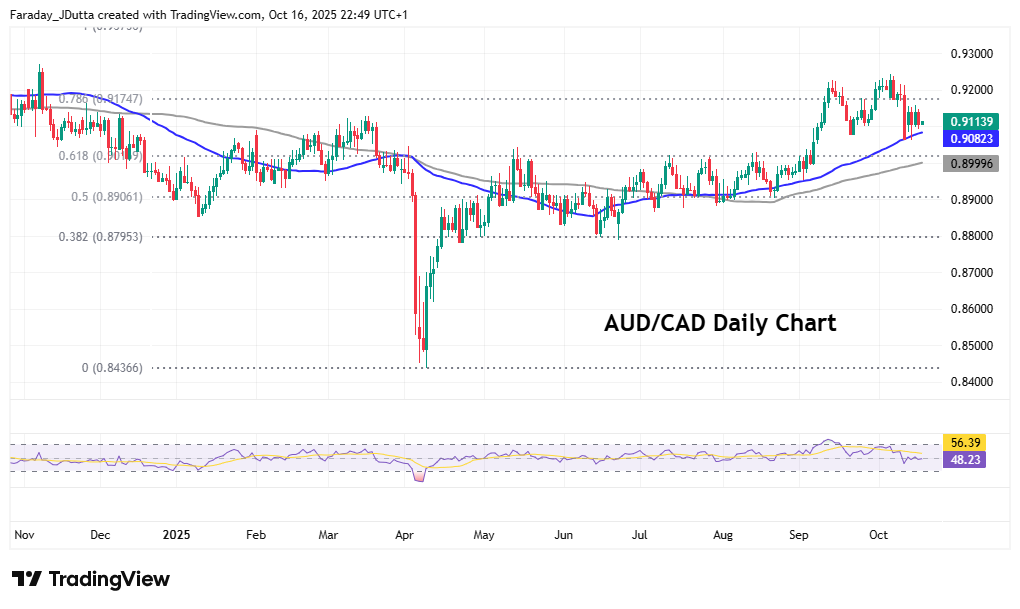

Chart of the Day – AUD/CAD finds support at 50-day SMA

AUDCAD pushed higher in early September, out of its previous range that had prevailed in the cross since May. A prolonged period of range trading typically sees a sharp move with range expansion in line with the dominant long-term trend, and prices rose sharply through a major Fib level of the September 2024 to April 2025 move at 0.9016. This former ceiing is now major support. The pair broke through the next retracement level (78.6%) at 0.9174 but found resistance above 0.92 on several occasions. A higher range can develop between 0.9050/0.9250 with initial support at the 50-day SMA at 0.9079.