Trump vs the Fed(’s Cook) sees dollar down

* Dollar trades lower as Trump’s move to fire Fed governor spooks investors

* Stocks close higher as focus turn to Nvidia earnings release

* Gold rises on Fed independence concerns

* Options expect around a 6% swing, higher or lower, in NVDA shares post-earnings

FX: USD sold off modestly after Monday’s solid gains retraced a lot of the losses from Friday and Powell’s flip-flop. Markets digested President Trump’s letter to the Fed’s Cook which put into further doubt the central bank’s independence. Trump could be on course for a majority on the Fed board, though the regional ones are somewhat more difficult to politicise. The 50-day SMA is at 98.06.

EUR outperformed despite an unfavourable environment of French political risk. French PM Bayrou called for a vote of no confidence on his government’s fiscal plans on September 8. The French stock market was initially down over 2% before closing 1.1% lower. For the euro, interest rate differentials remain supportive with the German-US yield spreads just below recent highs. The 50-day SMA sits at 1.1654.

GBP performed mid-pack after the long holiday weekend in the UK. The latest BRC shop price data showed that UK food inflation in August rose to its highest level since February 2024. Markets continue to fade BoE rate cut bets. This came after MPC hawk Mann said a more persistent hold on rates is appropriate right now. She had voted for a hold at the August BoE meeting.

JPY tracked sideways but stayed below 148. Notably, JGB yields made fresh multi-decade highs. The 50-day SMA is acting as support at 146.93.

AUD was modestly bid even after dovish RBA minutes. The Board saw a strong case for a 25bps cut and more was likely needed ahead. CAD strengthened versus the dollar after hitting three-month lows on Friday at 1.3924. Markets are still pricing about 8bps of easing for the BoC September meeting. But scope for easing remains limited given that inflation remains well above target.

US stocks: The S&P 500 printed up 0.41% at 6,465. It was a small bullish outside day with a strong close. The Nasdaq settled up by 0.43% at 23,525. The Dow Jones finished higher at 45,418 adding 0.3%. Sectors were predominantly green with Industrials and Financials the top gainers, while Consumer Staples and Real Estate lagged with Energy and Communication Services. Apple said there would be a special event on September 9 where the iPhone 17 is expected to be announced. Boeing reported that Korean Air had agreed to buy 103 aircraft in a $36bn deal. All eyes are on the release of Nvidia’s quarterly earnings after the US closing bell. See below for more detail.

Asian stocks: Futures are mixed. Regional markets were mostly softer on Trump rhetoric around more big levies if countries didn’t remove digital taxes while the Friday post-Powell reaction was faded. The ASX 200 sold off amid a deluge of company earnings. The Nikkei 225 struggled with Nissan lower as Mercedes-Benz offloaded its 3.8% stake and notable weakness in power names. The Hang Seng and Shanghai Composite retraced initial losses and returned to flat with some resilience seen after another firm liquidity operation by the PBoC.

Gold touched a two-week high after the Trump firing Cook news and made new highs on the close in a bullish breakout. Friday’s Powell pivot to a September rate cut and the fall in the dollar and Treasury yields typically should help non-yielding assets like bullion.

Day Ahead – Australia CPI

Australia July headline inflation is expected to rise 0.5% m/m and 2.0% y/y. The annual trimmed mean measure is forecast to hold steady at 2.1%. The RBA’s August forecasts predicted headline CPI would move above 3% in the second half before cooling. But currently, indicators are at the bottom of the RBA’s target band. Economists say that the first month of the quarter is typically not as useful as other readings as it is skewed to goods prices updates. The next inflation report is released a week before the RBA meeting on the last Tuesday of September.

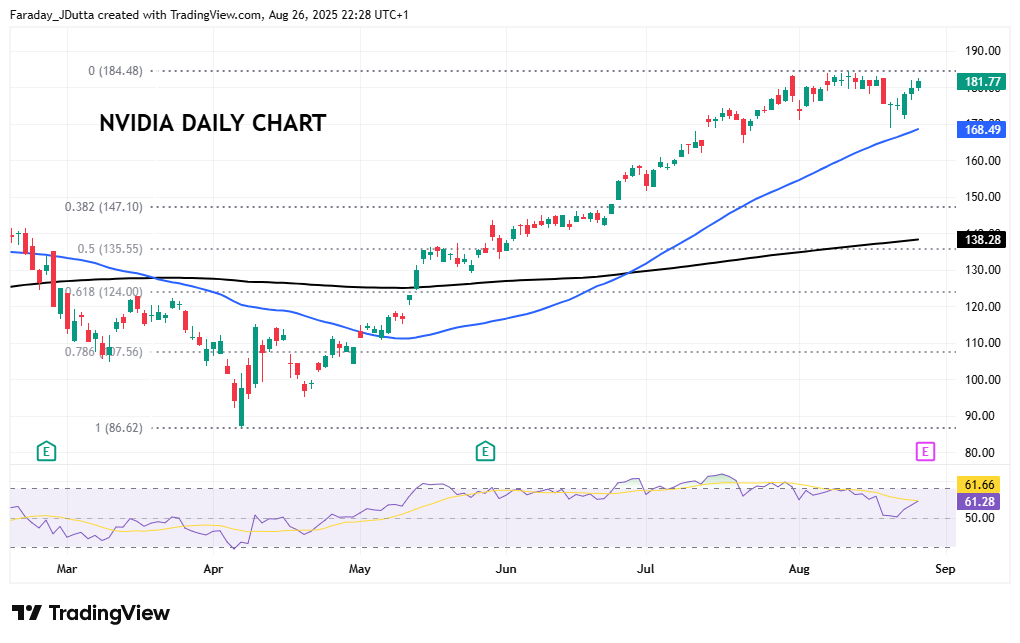

Chart of the Day –Nvidia hovering just below record high

The biggest company on the planet reports its quaterly earnings on Wednesday after the US closing bell. Nvidia is a bellwether for tech stocks and the broader market due to its colossal market cap. The chipmaker represents roughly 8% of the S&P 500, as it is now worth $4.4 trillion, which exceeds Microsoft by 20%. Results are set to be stellar, though we won’t see triple-digit gains as seen in previous years. Q2 EPS is forecast at $1.00 (Q3 guidance of $1.20) with revenue jumping 53.2% to $46.02bn (Q3 of $53.4bn). Gross profit margin is expected at 72% and guided to 73% in Q3.

The focus will be on margins, guidance and China revenues after the deal with the Trump administration to give it 15% of Nvidia’s China chip exports and the subsequent Beijing efforts to stall chip imports. Notably, last year, China accounted for 13% of Nvidia’s revenue while the chipmaker could take a 5 to 15% hit to gross margins on China-bound chips due to the federal deal, according to some analysts. Options markets see around a +/-6% move after the release. The record top is $184.48 and initial support is around $168.80/170.